The Importance of Pre-Qual

Bozeman Real Estate

Tim Ford | Friday Mar. 1st, 2019

It’s been a great winter in Bozeman, lots of snow to play in and some great days on the mountain. The Real Estate market has remained steady, but many buyers have been thwarted by the lack of inventory. With spring around the corner, we’ll likely start to see home sellers come out of their hibernation as well.

One of the first steps in searching for a new home should be to meet with a lender to determine whether a buyer qualifies for financing. Meeting with a lender may not seem like the fun part of the process, but it is vitally important to tackle this obstacle early in the search.

I’ve stressed this over the years, and I’m often told by would-be buyers that they’ll have no issues qualifying for financing, and this is generally the case. However, the purpose of the pre-qual goes beyond assuring the buyer and their agent that the buyers can get financing.

The strongest reason for getting pre-qualified is to be in a solid position when making an offer. In the Bozeman market, many new listings are generating multiple offers, often within a matter of days. If a buyer does find that right home, they may not have enough time to start the pre-qualification process from scratch if they want to get an offer in the mix.

I’m not sure why it is, but it seems like I’ve written up a lot of offers with buyers on Friday afternoons. Perhaps it’s because many buyers get off early on Friday. In any event, if a buyer finds that perfect home and they’re putting together an offer on a Friday at 5:00, if they haven’t met with a lender yet, it’s unlikely they’re going to be able to get anything done until Monday at the earliest. In today’s fast-moving market, that may not be soon enough.

The pre-qualification process can be even more important for high net-worth individuals. Many high net-worth individuals have complicated tax returns and various sources of income. A lender may need some time to find the best route to get them approved.

Another important reason to meet with a lender early in the process is to ensure that the buyer’s credit score is accurate. It is not unusual for a consumer’s credit report to contain inaccuracies that may lead to a lower credit score. The earlier in the process that this is discovered, the more quickly it can be resolved.

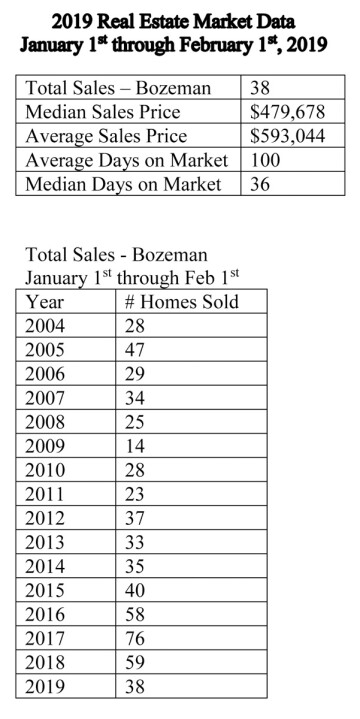

I have included recent sales data for the first month of 2019, including the median & average sold prices for the last 6 months. In addition to the 38 homes sold in January, another 119 homes are currently under contract or pending as of the date of writing.

The included data reflects sales of homes in the greater Bozeman area, including Four Corners, Gallatin Gateway, Bridger Canyon, and Bozeman city limits. The data includes home sales reported through the local Big Sky Country MLS, and does not include private party sales, Condominiums, or Townhouses.

| Tweet |