The State of Your Fun(ds)

photos by Zach Hoffman, by Ashley Nettles | Wednesday Feb. 28th, 2018

Raise your hand if you made a financial New Year’s resolution. Raise your hand if your best intentions already seem like a faded memory. Found an incredibly cheap ticket to Ireland that completely threw a monkey wrench into your budget? Just me? Ok ok. We’ll cover travel hacks soon. But for now, let’s see if we can get your goals back on track.

Budget: What an ugly word.

It sounds a little similar to burpees, which lets face it, even the most inspired athlete isn’t excited about. The words ‘necessary evil’ come to mind. There is article upon article that will tell you to quit your coffee habit, give up your hobbies and generally give up on life so you can maybe, just maybe, retire some day. A budget is usually portrayed as a strict parent pointing out your weaknesses. It doesn’t have to be, I promise. It can be freeing, even dare I say, exciting.

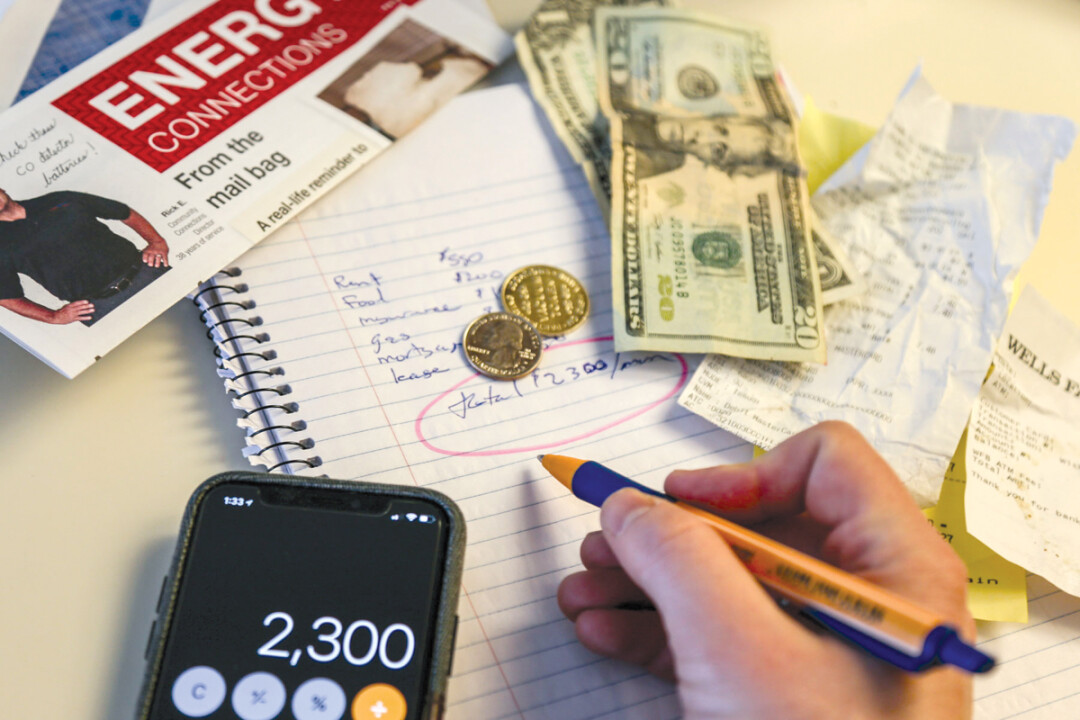

Step 1: You need to know where your money is going.

In a recent study from U.S. Bank, nearly 60% of Americans don’t keep track of their money. How did we end up here? As a child, when you are first given an allowance, you’re very aware of how much the thing you want costs, and how many chores are needed to be able to purchase it. Adolescence brings small gigs that increase your spending money, but you still know exactly how much that movie and dinner is putting you back. College comes with its fast and hard lessons. You spend too much on one thing (beer), and you’re quickly aware how it’s hurting you elsewhere (gas isn’t really necessary is it?). Slight segue, if you’re looking to score a great happy hour, free food, cheap anything, find your nearest college student. They are a wealth of information on scoring a deal. Once you have a career that successfully pays your bills and leaves a little left over, you loosen your grip on your funds. It’s all too easy to realize you have no idea where that last paycheck went. It’s time to change that.

Personally, I am a fan of the app Mint. It’s a budgeting software that links all your accounts together, so you can have a clear picture of where your money is going. It also has bill reminders and credit score checks. So pull off the bandaid, link your accounts and get a clear picture of where your money is going.

Step 2: Holy moley, I spent how much on ____?

This is where you organize your spending into three categories. Needs, Wants, Wishes. Needs are things like groceries, rent, and utilities. Wants are things that if you were living very frugally you probably don’t HAVE to have, but they certainly make your life better or easier in some capacity. Internet service, gym memberships, daily coffee runs. Wishes are things you don’t have to have but are just spending money on anyway, often without realizing it. Subscriptions you don’t use, eating out because you forgot your lunch, the Amazon purchases after three glasses of wine. (We’ve all been there. I now have a 3-year supply of Sonicare toothbrush heads and a paper towel holder shaped like a monkey.)

Step 3: Negotiate.

Just because they’re needs, doesn’t mean you don’t have some wiggle room. Electric bill unusually high? Check and see if someone in the house is leaving the lights or the TV on all day. Northwestern Energy has a free service that will check your house for energy efficiency. You can call (800) 823-5995 to set up an appointment. They do a great job of suggesting ways you can lower your bill. Cell phone bill killing you? See about switching plans or joining someone else’s.

The Wants are always negotiable too. I have a Sirius XM subscription that I could live without, but thanks to calling once a year and seeing what they can do for me, the subscription is cheap enough I find it excusable. You can always call your internet provider to work out a deal (often threatening to cancel will get you there). You never know until you ask. All you have to lose is paying the same amount you always have. Shop around for gym memberships. During the low season, after the rush of resolutions, they will often waive joining fees. Does your workplace get a discount? All of this may seem like a lot of leg work for a few dollars, but they add up. Plus, you’re not the chump over paying just because you didn’t ask. It never hurts to call.

Step 4: Identify what really makes life worth living.

This is the part where I tell you it’s ok to have your daily latte. Sort of. You need to sit down and have a serious conversation with yourself on what matters in your life. What are you willing to spend less on to be able to have these things?

Early in my working days, I was a barista. I’m not a huge coffee drinker myself, but I completely understand the connection between coffee, having your ‘place’, and enjoying the ritual. If skipping your daily coffee is going to make each and every day that much harder to bear, don’t do it. Sure, you can save a lot of money not going to the coffee shop daily, but if that really ruins you, it’s not worth it. Nor will you stick with it. If you turn into a bear of a co-worker without the joe, please save us all and drink your coffee.

You realized you’re eating out 5 times a week? A little extra time in the morning or on the weekend will save those random food trips. You had no idea how much Target was sucking away? (I can never escape that place for under $75 I swear). Make a shopping list and stick to it the next time you go. Download the app Cartwheel. Order what you need online and pick it up at the service counter to avoid getting distracted by shiny new objects.

Step 5: Set up your game plan. (A.K.A. Budget)

I love to travel. I never regret spending money on an experience. I like some sweet new swag from clothing stores too, but my love of travel wins out. I’m happy to sacrifice an expensive dinner here and there or a new shirt and pants to go explore. In my mind, an experience, even a hellacious trip where I lost my passport, luggage and wallet in Panama, left a more incredible memory than that sweet shirt I got a Bergdorf’s (although it is a timeless piece that I love too). Find what makes you happy. Does that $5 latte bring great joy to your morning? Keep it. Designer shoes are your jam? Buy them. But understand that it’s a trade off. And the more you can reduce the other things, the more you can put towards what really keeps you happy. Mint will help you set a budget based on your current spending. Take a look and see what looks reasonable, or what you can do without. The idea here isn’t to cause great pain in frugality. Budgeting isn’t a punishment. It’s financial freedom to get what you really want.

Step 6: Maintenance.

Nothing changes overnight. You’ve identified your weaknesses (Cafe M breakfast burritos) and how you can change it (pack your own breakfast the night before). There will be a morning in which that breakfast burrito is calling your name, you’re tired, and you just can’t resist. That’s fine. It doesn’t mean you completely blew it and you guiltily choke it down. Enjoy it! And resolve to ready your breakfast at home tonight.

| Tweet |