First Steps for First-Time Home Buyers

Tim Ford | Wednesday Feb. 28th, 2018

The process of buying a home can seem daunting to many first-time home buyers. It is a big step, but it is also rewarding and satisfying. There is a special pride in home ownership that makes the process worthwhile.

One of the first steps in searching for a new home should be to meet with a lender to determine whether a buyer qualifies for financing. Many times, buyers will start looking for homes first. Meeting with a lender may not seem like the fun part of the process, but it is vitally important to tackle this obstacle before a buyer starts touring properties.

An important consideration is to determine what price range the buyer can afford. Many first time buyers may be pleasantly surprised to learn they can afford a more expensive home than they thought possible. Alternatively, if they have toured homes priced around $350,000, they may be disappointed to learn they can only qualify for up to $250,000. Meeting with a lender before touring properties removes the guess work and gives a concrete spectrum of pricing in which to look for a new home.

Another important reason to meet with a lender early in the process is to ensure that the buyer’s credit score is accurate. It is not unusual for a consumer’s credit report to contain inaccuracies that may lead to a lower credit score. The earlier in the process that this is discovered, the more quickly it can be resolved.

Additionally, it is quite common in today’s market for properties to receive multiple offers. The pre-qualification letter really helps a buyer to be competitive. A lot of offers are also put together on a Friday evening or over the weekend when banks are closed. Being able to provide supporting documentation with the offer really helps.

The Human Resource Development Council (HRDC) also offers classes for first-time home buyers. These classes are HUD certified and cover the home buying process from preparation through closing. These classes may also qualify the buyer for down payment assistance, lower interest mortgages and matched savings programs. The HRDC office in Bozeman is located at 32 South Tracy; the phone number is (406) 587-4486, or online at www.thehrdc.org.

With a head full of knowledge from the first-time home buyer course and a letter of pre-qualification in hand, the buyer is now ready for the fun part: touring properties! The road to home ownership may seem long and intimidating, but as any proud homeowner will say, the destination is well worth the journey.

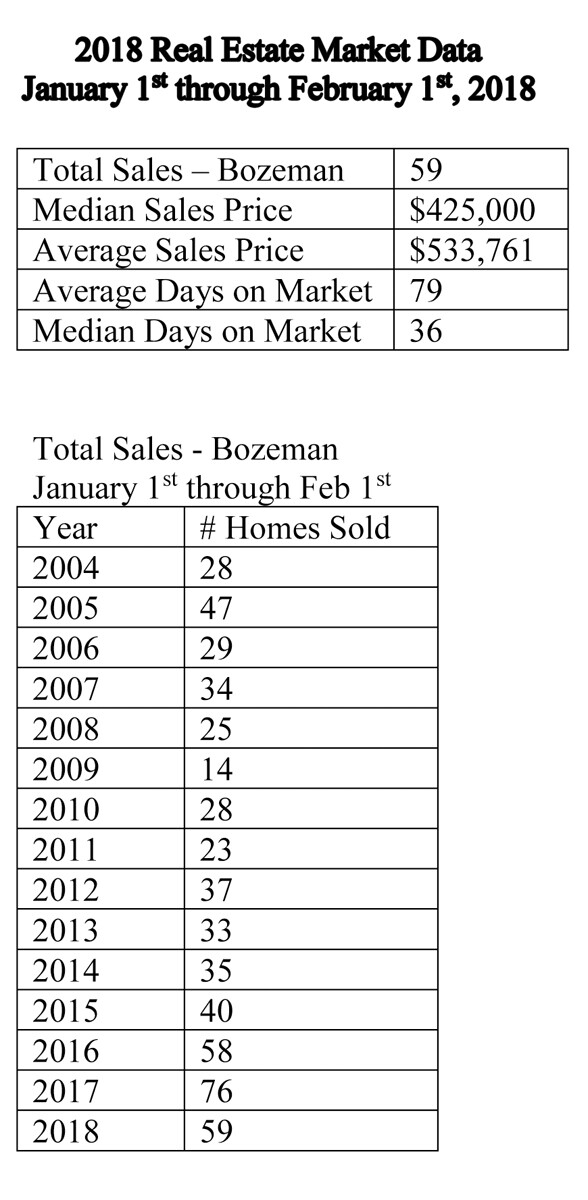

I have included recent sales data for the first month of 2018, including the median & average sold prices for the last 6 months. In addition to the 59 homes sold in January, another 140 homes are currently under contract or pending as of the date of writing. This is compared to 135 pending sales at this same time last year.

The included data reflects sales of homes in the greater Bozeman area, including Four Corners, Gallatin Gateway, Bridger Canyon, and Bozeman city limits. The data includes home sales reported through the local Southwest Montana MLS, and does not include private party sales, condominiums, or townhouses.

| Tweet |